1. Company Overview

Apple Inc. designs, manufactures, and markets smartphones, personal computers, tablets, wearables, and accessories worldwide. It also sells a variety of related services. The company was incorporated in 1977 and is headquartered in Cupertino, California. Apple is renowned for its innovation, premium branding, and strong customer loyalty, driven by its integrated hardware, software, and services ecosystem. Key products include the iPhone, Mac, iPad, Apple Watch, AirPods, and the recently launched Apple Vision Pro. Its services portfolio includes the App Store, iCloud, Apple Music, Apple TV+, AppleCare, and various advertising and payment services.

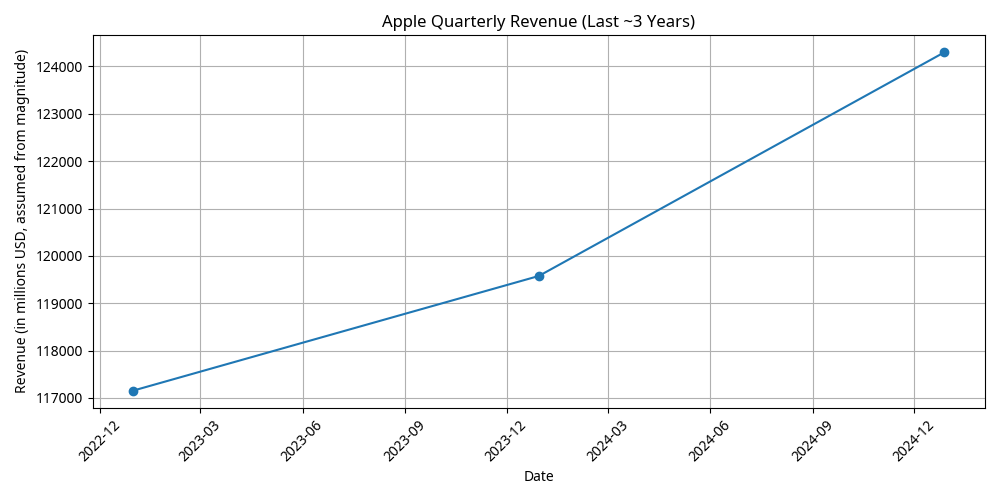

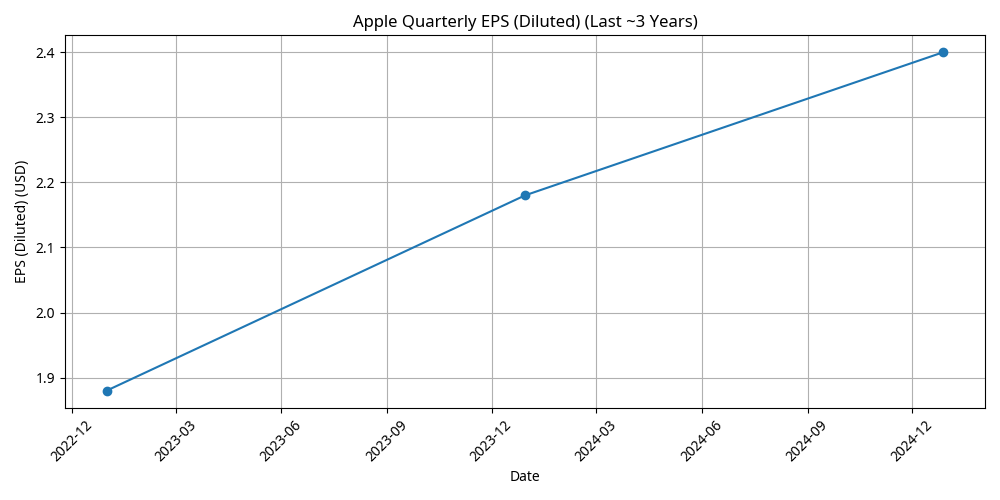

2. Financial Performance & Trends (Last ~3 Years)

2.1. Revenue Trend

2.2. Net Income Trend

2.3. EPS (Diluted) Trend

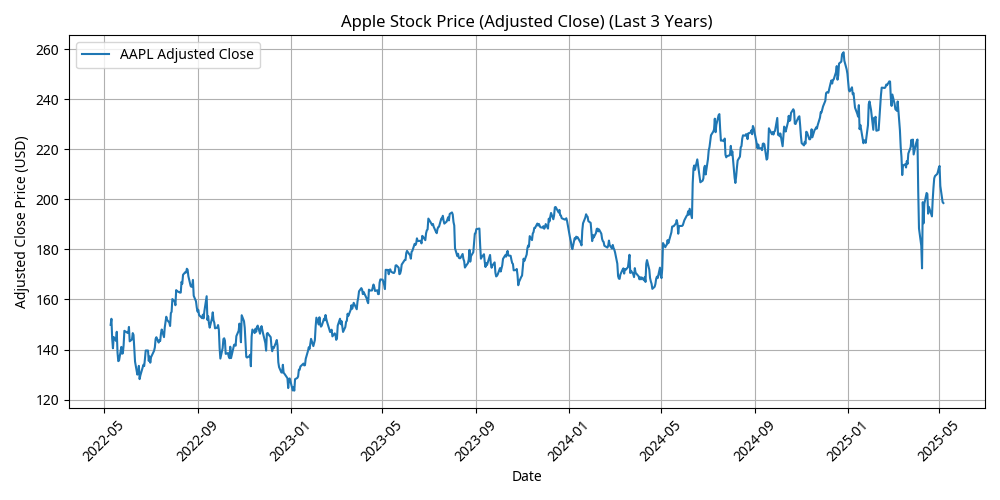

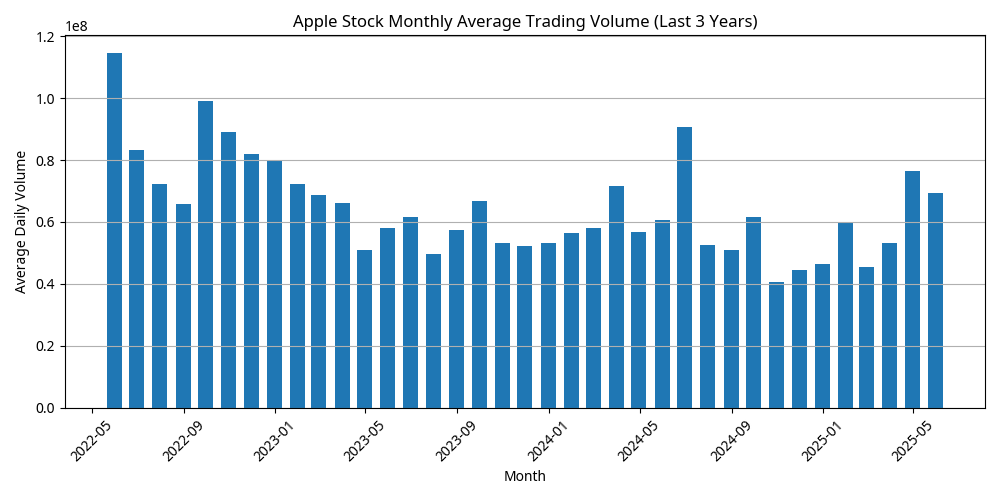

3. Stock Performance (Last 3 Years)

3.1. Stock Price Trend

3.2. Trading Volume Trend

4. Key Financial Ratios Trends (Last ~3 Years)

4.1. Gross Margin Trend

4.2. Operating Margin Trend

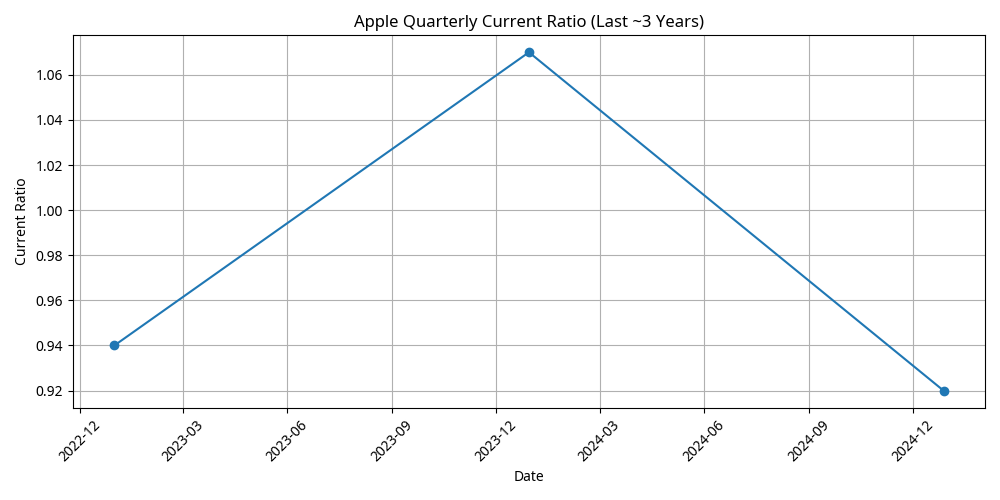

4.3. Current Ratio Trend

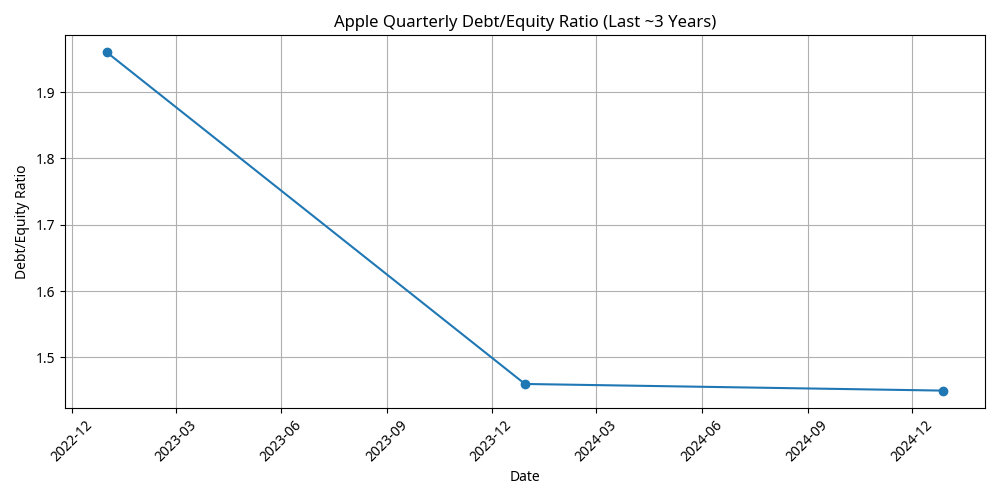

4.4. Debt/Equity Ratio Trend

5. EPS Prediction & Outlook (Coming Year)

6. SWOT Analysis

7. Conclusion & Recommendation

Apple Inc. demonstrates strong financial health, consistent innovation, and a powerful brand with a loyal customer base. Its growing services segment provides a significant avenue for future growth and margin expansion. While facing intense competition, regulatory scrutiny, and geopolitical risks, Apple is well-positioned to leverage its strengths and capitalize on opportunities in new product categories, emerging markets, and AI integration.

The analysis of recent financial trends, stock performance, and market insights, including a target price of $ and a general rating from analysts (as per Yahoo Finance insights), suggests a positive outlook for the company. The predicted direction for EPS, while mixed in the short-term technical outlooks, is generally supported by strong fundamentals and growth initiatives.

Recommendation: Based on the comprehensive analysis, we are initiating coverage on Apple Inc. (AAPL) with a BUY rating. The company continues to be a core holding for long-term growth-oriented investors, though monitoring of competitive dynamics and regulatory landscapes is advised.